Backtesting NSE Option Chain Strategies: Evaluating Historical Performance for Future Success

The NSE Option Chain offers a vast array of trading opportunities, presenting both potential rewards and inherent risks. To navigate this dynamic market effectively, traders rely on various strategies to capitalize on market movements and generate profits. However, before deploying these strategies in real-time trading, backtesting provides an invaluable tool for evaluating their historical performance and potential future success.

What is Backtesting?

Backtesting involves simulating a trading strategy using historical data as if it were implemented in the past. This process allows traders to assess the effectiveness of a strategy under various market conditions and make informed decisions about its suitability for future trading. Check what is demat?

Benefits of Backtesting NSE Option Chain Strategies

Strategy Evaluation: Backtesting provides an objective assessment of a strategy’s performance, revealing its strengths and weaknesses. Traders can identify profitable strategies worth pursuing and discard those that consistently underperform.

Risk Management: Backtesting helps quantify the risks associated with a strategy, including maximum drawdowns, win rates, and average profit/loss per trade. This information is crucial for risk-averse traders and allows for informed position sizing and capital allocation. Check what is demat?

Performance Optimization: Backtesting allows for refining and optimising strategies by adjusting parameters, such as strike prices, expiration dates, and entry/exit criteria. This optimization process can enhance the strategy’s effectiveness and potential profitability.

Emotional Discipline: Backtesting removes the emotional element from trading decisions, allowing traders to make objective assessments based on historical data rather than impulsive reactions to market fluctuations.

Improved Trading Confidence: Successful backtesting instils confidence in traders, enabling them to approach real-time trading with a clearer understanding of their strategy’s potential and limitations.

Backtesting NSE Option Chain Strategies Effectively

Data Selection: Choose a representative sample of historical data that reflects the market conditions and trading environment in which the strategy will be implemented. Consider factors such as market volatility, liquidity, and underlying asset characteristics. Check what is demat?

Strategy Implementation: Simulate the strategy’s execution rules and trade timing as closely as possible to real-time trading conditions. This includes factors such as entry/exit criteria, position sizing, and order placement.

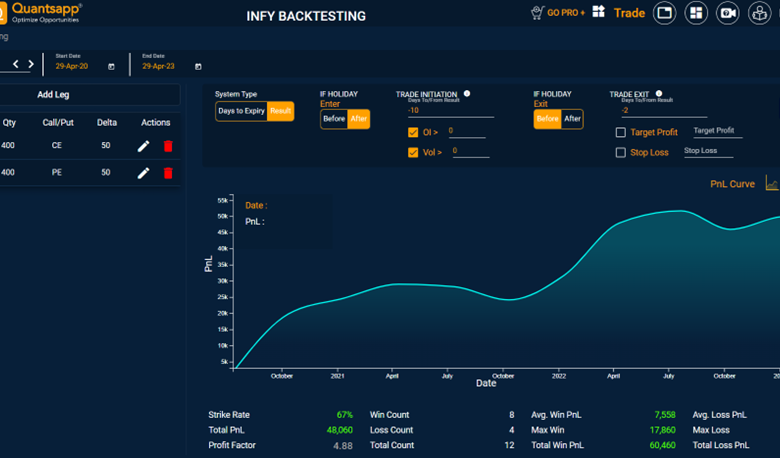

Performance Metrics: Evaluate the strategy’s performance using relevant metrics, such as total return, win rate, average profit/loss per trade, maximum drawdown, and Sharpe ratio. These metrics provide insights into the strategy’s profitability, consistency, and risk profile. Check what is demat?

Sensitivity Analysis: Analyze the strategy’s sensitivity to changes in market conditions and parameters. This helps assess the strategy’s robustness and adaptability to different market environments.

Continuous Refinement: Backtesting is an iterative process. Traders should continuously refine their strategies based on backtesting results, market conditions, and their evolving trading goals.

Conclusion

Backtesting is an indispensable tool for traders seeking to navigate the complexities of the NSE Option Chain with greater confidence and success. By evaluating the historical performance of trading strategies, traders can identify profitable opportunities, manage risks effectively, optimise their strategies for better outcomes, and make informed decisions that align with their financial goals. Remember, backtesting provides valuable insights but does not guarantee future success. Traders should always exercise caution, adapt their strategies to changing market conditions, and maintain a disciplined approach to risk management. Check what is demat?